In a global environment marked by rising input costs, increasing climate volatility and growing demands for transparency, the weakest link in the supply chain often begins at the source: the farm. For corporations operating across the food value chain ensuring supply continuity is no longer just an operational challenge. It’s a strategic imperative.

Labour shortages, unpredictable yields, and inefficient resource use are not just agricultural problems, they’re direct threats to margin stability, contractual performance, and ESG compliance. In Europe alone, the agricultural labour shortfall could exceed 4 million workers by 2030 (Source: EU Agriculture Outlook). Meanwhile, global demand for fresh food continues to rise, as does pressure from consumers and investors to build more resilient, traceable supply chains.

While global demand for fresh food keeps rising, rural communities continue to age, and younger generations opt for less physically demanding jobs. This labour gap exposes the entire chain — from small producers to multinational retailers who rely on them to keep shelves stocked every day. But it’s not just about labour: climate volatility, mounting pressure to cut emissions and the demand for greater traceability add more complexity, requiring new tools to keep production flowing.

The most forward-thinking players are responding with a clear strategy: technological convergence. It’s no longer about isolated sensors or drones; it’s about connected ecosystems where hardware, IoT, AI, data science and robotics come together to multiply impact.

- Soil and climate sensors, connected to the cloud, help automate irrigation and fertilisation, optimising inputs and cutting costs.

- Drones and autonomous robots, guided by machine learning algorithms, monitor crop health, detect pests early and support harvesting — easing the strain on shrinking teams.

- Cloud-based analytics platforms combine satellite imagery, weather forecasts and operational data to enable faster, evidence-based decisions.

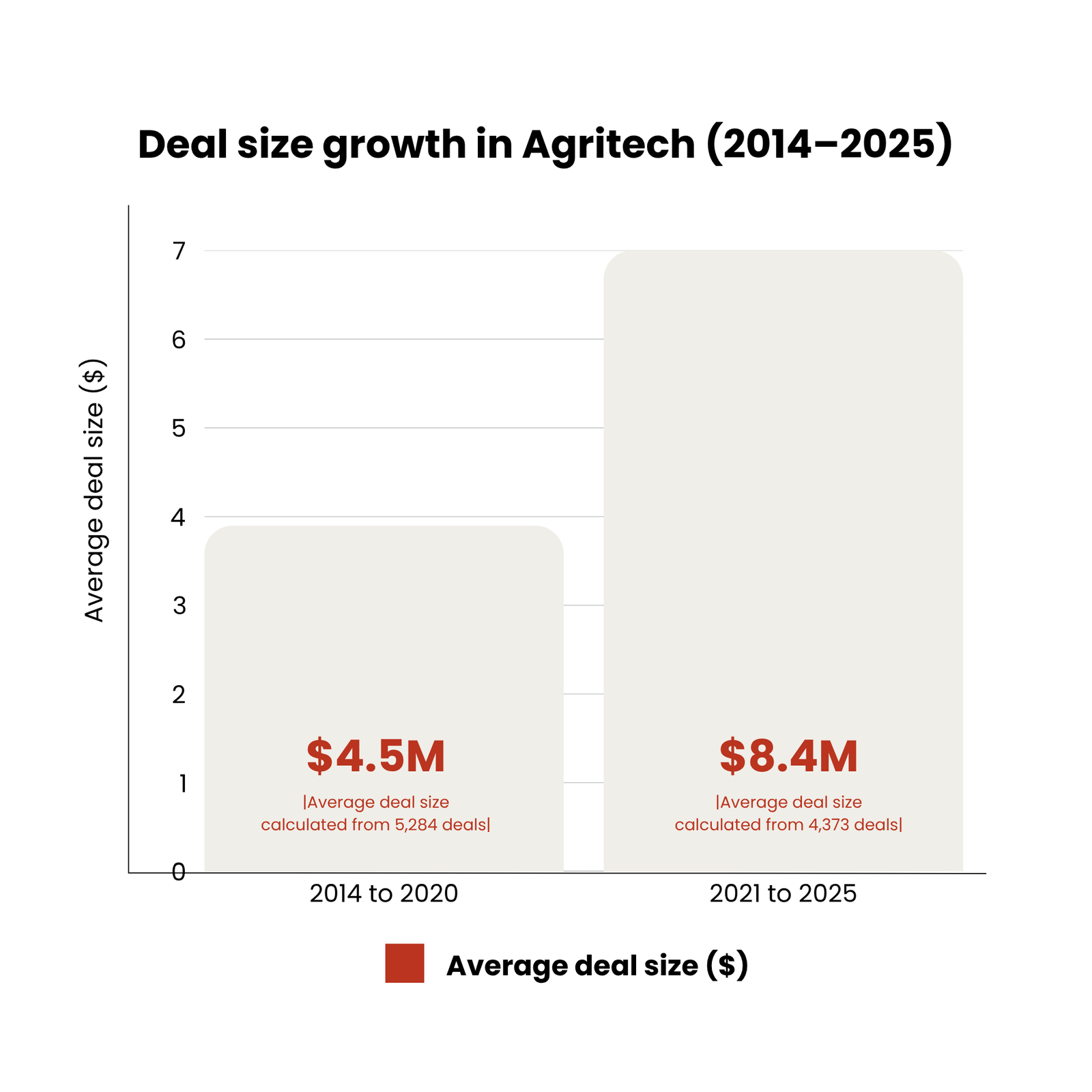

The sector is clearly evolving. While overall investment in Agritech has declined since its 2021 peak, the average deal size has grown significantly from €4.5M in 2014–2020 to €8.4M in 2021–2025. This suggests that capital is now more concentrated in fewer, more mature companies, pointing toward a market that is consolidating and scaling. The number of deals has dropped sharply in recent years, but investors appear to be backing larger, more promising opportunities.

Source: Elaborated by Eatable Adventures, based on Dealroom data, 2025. Data for 2025 is annualized based on figures available up to July.

Leading Stakeholders shaping the smart farming landscape

A new wave of agri-food players is showing what’s possible when smart technologies converge. These companies are proving that the future of farming is already here for those bold enough to start building the foundation.

John Deere, for example, is pushing the boundaries of precision agriculture by combining GPS sensors with AI algorithms. Farmers using these systems can plan crop patterns more accurately, optimise irrigation and prevent soil compaction, boosting yields by 10–15% while cutting costs by the same margin.

The Climate Corporation (Bayer) has become a leader in data-driven agriculture through its FieldView platform, which integrates satellite imagery, weather forecasts and field data. This approach helps growers in the US make more informed decisions, delivering a 5–10% increase in yields across more than 40.5 million hectares.

Meanwhile, startups like Aflabox.ai are tackling critical food safety risks through real-time IoT and AI monitoring of aflatoxins in stored grains. By predicting contamination threats early, they help producers reduce waste, maintain quality and ensure compliance, creating tangible value for the entire supply chain.

What if the solution wasn’t more technology, but smarter orchestration?

The real breakthrough doesn’t come from stacking tools, but from integrating them intelligently. Where robotics speaks to AI. Where sensors anticipate. Where data not only describes, it decides.

The transformation of the food system won’t be linear. It will be exponential.

And that demands ecosystems built to think differently and act together.

In today’s increasingly complex agri-food landscape, the challenge isn’t adopting more tech, it’s giving it strategic direction. We partner with organizations that don’t just want to adapt, they want to build the rules of the game. From roadmap to pilot. From vision to execution.

Is the challenge already on your table? Let’s make it pulse.