In recent years, the digitalization of the agrofood sector has been accelerated by technologies like precision fermentation, AI, and IoT. Now, another industry that has been disrupting multiple sectors globally—fintech—is joining the ranks.

Fintech has penetrated quite fast, especially in emerging markets, due to factors like underdeveloped banking systems, widespread mobile phone use, and economic instability. In Latin America (LATAM), specific elements such as financial exclusion, a large remittance market that showcased the benefits of fintech and hyperinflation have enabled fintech to challenge traditional banking in unprecedented ways.

This article will explore seven key areas of fintech innovation within the agrofood sector and highlight proposals emerging in the south american region:

New payment solutions

Payment solutions apply for B2B and B2C marketplaces and transactions between farmers, suppliers, distributors, and consumers, reducing the need for cash. This trend is emerging in LATAM, due to the current high volume of cash transactions and the high penetration of mobile apps.

Point of sale (POS) systems

Primarily designed for restaurants and other food retailers, these systems streamline payments and help manage accounts receivable and payable, thus enhancing revenue and operational efficiency. They also offer real-time transaction analysis, delivering valuable insights into customer demographics, purchasing patterns, and peak buying times, along with predictive analytics. This data enables businesses to gain a deeper understanding of customer behavior and optimize their operations accordingly. Brazilian startup Zak is working to address these challenges in LATAM.

Agricultural loans and banking

This area will be especially important for LATAM, where access to funding is challenging due to factors like the unpredictability of agricultural outcomes, commodity futures prices, and an informal agricultural economy, which make banks reluctant to lend money. Additionally, traditionally high interest rates in Latin countries, driven by inflation and risk, further complicate the lending landscape.

The LATAM startups Agrolend (Brazil) and AgrodatAi (Colombia) are making advancements in this vast market, helping local farmers improve their outcomes. Another notable startup in this area is Weia (Colombia) which helps with supply chain financing.

Other potential applications could be the utilization of creditworthiness analytics supported by AI to provide more precise insights than traditional banking about the borrower’s creditworthiness, which would allow for customized and cheaper funding for small farmers, while also reducing lending costs and commissions through automation.

Commodity trading platforms in agriculture

These platforms increase transparency within the commodity sector by providing real-time pricing and facilitating direct transactions between buyers and sellers. They address issues such as information asymmetry and market inefficiencies, enabling fairer and more efficient trading.

Furthermore, these platforms can offer price transparency for agricultural products that do not trade on futures exchanges. The Argentinian commodity tokenization startup Agrotoken helps with the customized exchange of agricultural products between stakeholders, as well as using the tokenized products as collateral for funding.

Blockchain

Blockchain can streamline operations in marketplaces, commodities exchanges, and other platforms. Its most significant contribution will probably be in food supply chain tracking, where it enhances traceability, improves food safety, reduces fraud, and ensures transparency from farm to table.

Crowdfunding and investing

New asset classes from agricultural sectors with low correlation to traditional assets and acting as a hedge against inflation may be available for investors. That is the proposal of the Colombian startup Agrapp, which provides small farmers with funding from investors to increase their crops, acquire farmland, and generally boost their harvests.

Insurance

Thanks to analytics and AI, predicting potential risks and their consequences on a small scale has never been easier. This advancement enables automated insurance platforms to estimate risks and create customized insurance solutions with fewer resources and less time.

Agrofintech investment in LATAM

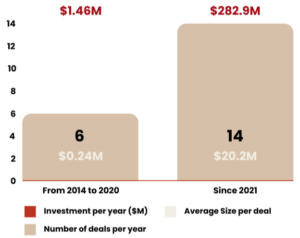

Source: Elaborated by Eatable Adventures, based on Dealroom data, 2024. Data for 2024 is annualized based on figures available up to June.

This surge in solutions will undoubtedly be driven by the emergence of startups in the region. As shown in the graph, there has been a rise in the number of venture capital deals in the fintech agrifood sector in LATAM in recent years, following a similar trend to the development of the major solutions mentioned. Although representing a small proportion of global investments, the number of new deals has been increasing, particularly since 2021.

It is inevitable that agrofintech will continue to grow in the agrifood industry in LATAM, driven by a rising number of investments, both in terms of funding and the number of deals.